Unlocking the Secrets to Successful Financing Applications and Authorization Procedures

Navigating the complexities of car loan applications and approval procedures can commonly seem like figuring out a puzzling code. There are essential strategies that can dramatically enhance your chances of success in securing the funding you require. By recognizing the complex dance in between lending requirements, credit history, lending institution selection, economic file organization, and application prep work, people can position themselves for favorable outcomes in the frequently daunting world of lending. These tricks, when introduced, hold the power to change the finance application journey into a smoother and much more gratifying experience.

Understanding Financing Requirements

When making an application for a loan, it is essential to completely understand the details demands established by the lending organization. These needs act as the foundation whereupon your car loan application will be assessed and approved. Lenders generally outline their criteria concerning credit history, income levels, employment history, and debt-to-income proportions. By acquainting yourself with these prerequisites, you can analyze your very own monetary situation to establish if you fulfill the certifications prior to proceeding with the application process.

Furthermore, meeting all the stated needs boosts your opportunities of securing the financing with favorable terms and conditions. Failing to meet these standards can result in delays or potential denial of your lending application, highlighting the relevance of understanding and satisfying the lender's needs.

Improving Credit Scores

Recognizing and fulfilling the details car loan demands set by borrowing establishments lays a strong foundation for customers to focus on improving their credit score scores, a vital variable in the lending approval procedure. In addition, maintaining a longer credit report history and avoiding frequent credit score inquiries can show stability to potential lending institutions. By actively handling and boosting their debt scores, customers can boost their possibilities of protecting loan approval at favorable terms.

Choosing the Right Loan Provider

Moreover, analyze the loan provider's funding terms, consisting of the repayment period, passion prices, charges, and any type of additional costs. By very carefully choosing a lending institution that suits your requirements, you can enhance the chance of an effective financing application and approval procedure.

Organizing Financial Papers

Efficiently organizing economic files is a basic action in planning for a lending application. Lenders call for various papers to assess an individual's economic wellness and creditworthiness. Beginning by gathering essential documents such as proof of earnings, consisting of pay stubs, income tax return, and bank declarations. Arrange these documents in a methodical manner, grouping them by group and day to assist in easy access and understanding for both on your own and the additional info loan provider.

Additionally, include documents pertaining to any outstanding financial debts, you could look here such as charge card declarations, trainee lendings, or existing home mortgages. Offering a comprehensive review of your monetary commitments will offer lending institutions a more clear photo of your capacity to take on added debt. In addition, be prepared to submit personal identification documents, such as a driver's permit or key, to confirm your identity. Easy to find a Fast Online Payday Loan.

Preparing a Strong Application

Having meticulously arranged your economic records, the following crucial action towards an effective lending application is crafting a compelling and extensive entry. Begin by submitting the application precisely, ensuring that all areas are finished with exact info. Be transparent regarding your financial circumstance, offering details on your income, expenses, properties, and responsibilities. It is necessary to consist of any additional documents that sustains your application, such as pay stubs, tax returns, financial institution statements, and proof of collateral if appropriate.

Final Thought

In verdict, effective loan applications and approval procedures depend on satisfying the lending demands, enhancing credit score ratings, picking the proper loan provider, arranging monetary papers, and submitting a strong application. Easy to find a Fast Online Payday Loan. By comprehending these essential elements and taking the needed actions to address them, individuals can increase their opportunities of safeguarding a financing and attaining their economic goals. It is vital to be well-prepared and proactive in the financing application process to ensure a smooth and effective outcome

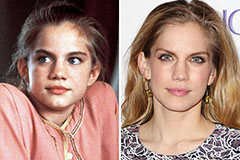

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!